Best Health Insurance Plans in India: The world has become home to diseases. Above all, inflation has become so much that it is not a matter of everyone to treat every disease. Everyone is aware of the plight of government hospitals. This is the reason that every year crores of people in the country are dying mercifully from various diseases.

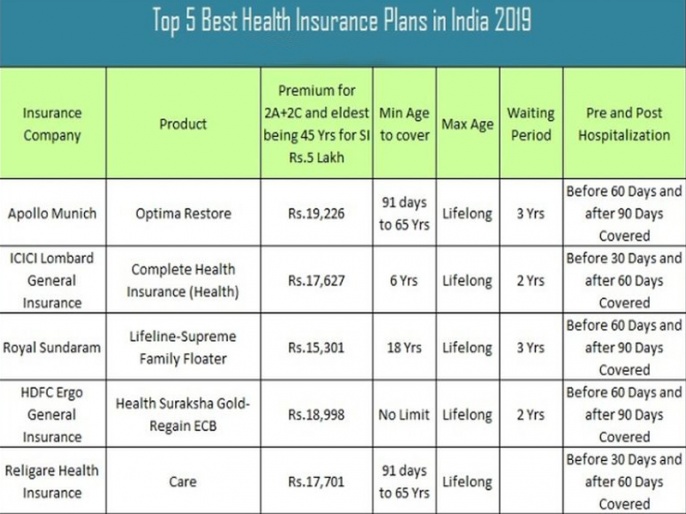

Best Health Insurance Plans in India: Why health insurance is important, what are the best health insurance plans in India and what should be kept in mind while taking health insurance? These are questions that everyone wants to know the answer to. Let us tell you that like life insurance, every person should also take health insurance. The world has become home to diseases. Above all, inflation has become so much that it is not a matter of everyone to treat every disease. Everyone is aware of the plight of government hospitals. This is the reason that every year crores of people in the country are dying mercifully from various diseases. Therefore, you must have a better health insurance plan so that you can get cheaper and better treatment if you are sick. Let’s know about the 5 best health insurance plans in India-

Keep these things in mind before taking a health insurance plan (Things to keep in mind while buying health insurance)

The rate of inflation for hospitalization is usually around 8% to 10%. Therefore, one should always consider health insurance with sufficient sum assured. Consider the members you are including in the policy. Based on this, you should choose a plan with an insured amount.

You will need to check the estimated claims ratio of health insurance companies. The estimated claims ratio or ICR is the ratio of the total value of claims paid or settled to the total premium collected in any given year. It can be calculated as ICR = (total value of total premium claimed) x 100. For example, suppose the company settled a total claim amount of Rs 90 crore in the year 2019-20. In the same year, it collected Rs 100 crore as the total premium. In this case, the estimated ratio is 90%.

Buy early

Policybazaar

It is better to buy any plan early in age. We do not know the health problems. Therefore, the insurer may decline your offer. Therefore, always buy immediately and never postpone. Apart from these, you should also understand things like cover, renewal date, waiting period, hospital network, premium etc.

Keep this in mind

Health insurance really depends on your age, family member, your health condition and the particular facility you are looking for. Therefore, the plan stated here is based on the general idea. It is always best to cross-check the product before purchasing any plan.

Apart from this, keep in mind that the plans mentioned above are not necessarily the top plans in India. These are just plans for big companies. Nowadays some small companies are also offering better plans. You should plan carefully.

English summary:Best Health Insurance Plans in India: Why is Health Insurance Important, what are the Best Health Insurance Plans in India and what things should be taken while taking Health Insurance? These are questions that everyone wants to answer. Let us know that every person should also get health insurance like Life Insurance.